# Transforming Our Financial Landscape: The Shift to Cryptocurrency

Written on

Chapter 1: The Evolution of Currency

For millennia, people have relied on various items such as seashells, animal teeth, jewelry, and livestock as barter tokens. However, as time progressed, gold and silver emerged as universally accepted forms of currency, laying the groundwork for our current financial systems.

This evolution from barter to monetary systems enabled smoother transactions, making trade more efficient and fostering the growth of commerce on a global scale.

> "Humans initially bartered for goods and services, which became impractical over time." — Nik Bhatia in “Layered Money”

Section 1.1: The Role of Gold in Our Economy

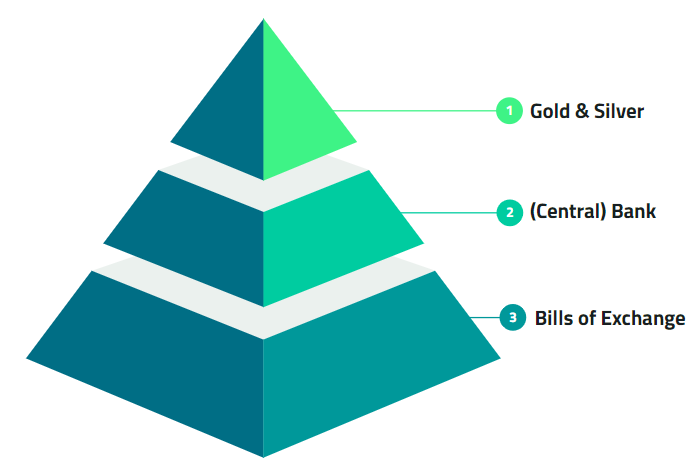

As commerce expanded, the limitations of using gold for transactions became apparent. It was heavy and challenging to secure, leading to the establishment of banks like the Banco dei Medici, which facilitated trade through bills of exchange. These bills promised the conversion into gold upon redemption, a practice that lasted until the abandonment of the gold standard in the 1930s.

Section 1.2: The Trust in Currency

Gold has always been a trusted asset, serving as a reliable backing for currencies. The United States, holding the largest gold reserves, exemplifies this trust, which is crucial for its status as the world’s reserve currency. The enduring value of gold makes it a safe asset across generations.

Chapter 2: The Rise of Bitcoin

With the advent of Bitcoin, often dubbed "digital gold," we are witnessing a radical transformation in our monetary system. Bitcoin's design allows for easier security and transportation compared to gold. Its blockchain technology enhances transparency, reliability, and security—attributes essential for a future global currency.

Video Description: In "Broken Money: Why Our Financial System Is Failing Us," the discussion revolves around the challenges of the current financial framework and how we might improve it.

Bitcoin’s rise in popularity reflects a growing distrust in traditional financial systems, particularly highlighted during events like the Robinhood controversy. Many younger individuals now see Bitcoin as a viable future currency, with cities like Miami considering its use for employee salaries.

Section 2.1: The Layers of Cryptocurrency

In the emerging financial system, Bitcoin and Ethereum are positioned at the top of the monetary pyramid. Layer 2 encompasses various platforms, including crypto banks and exchanges, while layer 3 focuses on facilitating transactions through digital assets, NFTs, and decentralized marketplaces.

Video Description: In "Raoul Pal's Warning On The US Dollar," the speaker addresses concerns regarding inflation, debt, and the potential for a financial crisis amid the rise of Web3 technologies.

Section 2.2: Financial Accessibility for All

Unlike traditional wealth-building assets, cryptocurrency is accessible to everyone. With no exorbitant fees, individuals can invest in Bitcoin and other cryptocurrencies without the barriers associated with stocks or real estate. Crypto banks like BlockFi allow loans without the need for credit scores, making financial opportunities available to a broader audience.

Chapter 3: The Future of Finance

As the financial landscape shifts, traditional banks are beginning to recognize the importance of cryptocurrencies. Major institutions are exploring their own blockchain solutions, and the Federal Reserve is investigating the creation of a digital dollar.

Blockchain technology is revolutionizing how financial assets and loans are accessed, empowering individuals and minimizing reliance on intermediaries.

Section 3.1: The Democratization of Finance

The future of finance is about democratization, similar to how the Internet transformed information access. As cryptocurrency gains traction, it promises to create a system that benefits its users, fostering innovation and financial freedom.

In summary, the shift from traditional financial systems to cryptocurrency represents a profound change in how we understand and manage money. As this transformation unfolds, individuals must adapt to harness the benefits of this new financial era.

If you found this article insightful, please consider sharing it with others. Your engagement is appreciated!