# The NFT Market Collapse: A 99% Drop in OpenSea Trading Volume

Written on

The NFT Market's Downfall

At its peak in May 2021, the NFT marketplace OpenSea witnessed an astonishing $2.7 billion in trading volume. This surge was driven by a cryptocurrency bull market, tales of unimaginable wealth, and rampant fear of missing out (FOMO). Iconic collections like Bored Apes and Crypto Punks, alongside countless lesser-known JPEG projects, were snatched up by both celebrities and regular investors in a chaotic frenzy.

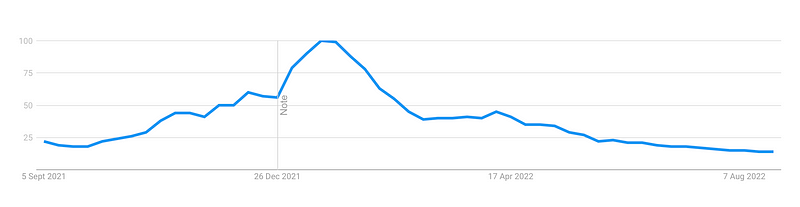

Fast forward to over a year later, and the once-bustling marketplace now finds itself overflowing with unsold items, creating a significant backlog. I have been documenting this decline, which began accelerating in March. The bubble that seemed poised to burst in May has now definitively collapsed.

A Dramatic Decline in Transactions

On August 28, OpenSea recorded a mere $9.34 million in transactions. This marks a staggering 99% drop from the previous high of $2.7 billion. While OpenSea has disputed this data—arguing that comparing their peak day to one of their lowest is misleading—it seems essential to analyze these two contrasting data points to understand the downturn. OpenSea prefers to highlight their ETH volume, which overlooks the ever-fluctuating cryptocurrency prices. According to Dune Analytics, the monthly ETH volume has plummeted by 140% since January 2022, indicating that the decline is real.

Furthermore, several indicators on the OpenSea platform reveal ongoing drops in NFT interest:

- Daily user visits are down by 50% since January 2022.

- Daily transactions have also seen a 50% decrease since the start of the year.

The floor price for Bored Apes, the flagship NFT, has dropped significantly from an average of 145 ETH to 77 ETH, translating to a decline from approximately $700,000 to $370,000 at the highest ETH price.

Rising Concerns Over NFT Viability

As time passes, the initial excitement surrounding NFTs has faded. Prominent figures like Eminem and Snoop Dogg have attempted to maintain relevance by integrating NFTs into their music videos and performances, but the reality is stark: NFTs have lost their mainstream allure, and the market is struggling to stabilize.

Why has this happened? The answer is straightforward. More than a year and a half after their meteoric rise, NFTs still lack substantial use cases. They have largely become expensive status symbols, enriching a select few through strategic timing or less-than-honest practices like scams. According to the site "Web3 is going great," over $10.5 billion has been lost to scams, many of which promised to emulate the success of Bored Apes.

As the market continues to decline, many retail investors find themselves trapped in a self-sustaining ecosystem that has stopped delivering returns. Evidence suggests that numerous NFTs are traded between accounts owned by the same person to artificially inflate their market value. Many projects rely heavily on social media hype to launch at high prices, only to see their value plummet when initial investors cash out.

The Future of NFTs

Just as quickly as they appeared, NFTs are fading from the public eye. Unfortunately, many of those still advocating for the technology may not genuinely believe in its potential. Instead, they seem focused on finding new buyers who are overly enthusiastic about the concept.

While there will always be a few winners, if you're left holding assets that are now worth 99% less than what you paid, it's hard to see yourself as anything but a loser. When demand evaporates entirely, it will leave a multitude of disappointed investors.

For more insights into business and technology, consider joining my membership program. Your support directly helps writers like me, and I earn a small commission if you sign up through my link. You can also follow me on Twitter for updates.