Mastering Crypto Futures Trading: Your Guide to Financial Freedom

Written on

Chapter 1: Introduction to Crypto Futures Trading

The cryptocurrency market presents significant opportunities for achieving financial independence, albeit with considerable risks involved. You can generate income through various methods such as staking, lending, trading, and holding investments. In this guide, however, we will concentrate specifically on the strategy of trading cryptocurrency futures.

What is Cryptocurrency Futures Trading?

On many crypto trading platforms, the futures market is also referred to as the derivatives market. This setup allows you to utilize borrowed funds from the platform to amplify your trading position, enabling you to manage a larger position than if you were trading solely with your own capital.

For instance, with an initial investment of $1,000, you could leverage that amount by 10 times, effectively controlling a position worth $10,000. We will delve deeper into this strategy later in the article.

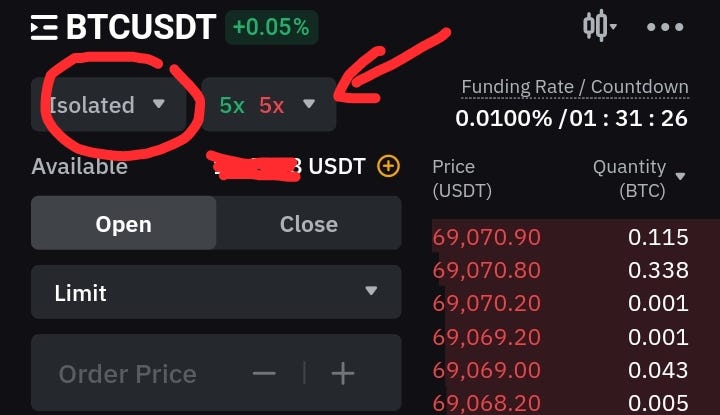

When it comes to trading assets like Bitcoin in the futures market, leverage can range anywhere from 1 to 125 times, based on the trading platform you choose. However, it's crucial to understand risk management to maintain discipline in your trading activities.

Just because your trading platform offers high leverage options, such as 100% or 125%, doesn’t mean you should always take advantage of them. For novice traders, utilizing excessive leverage is one of the quickest ways to incur losses in the cryptocurrency futures arena. Therefore, it’s advisable to manage your risk by opting for lower leverage, typically in the range of 5%-10%, to safeguard your capital, particularly during unfavorable market movements.

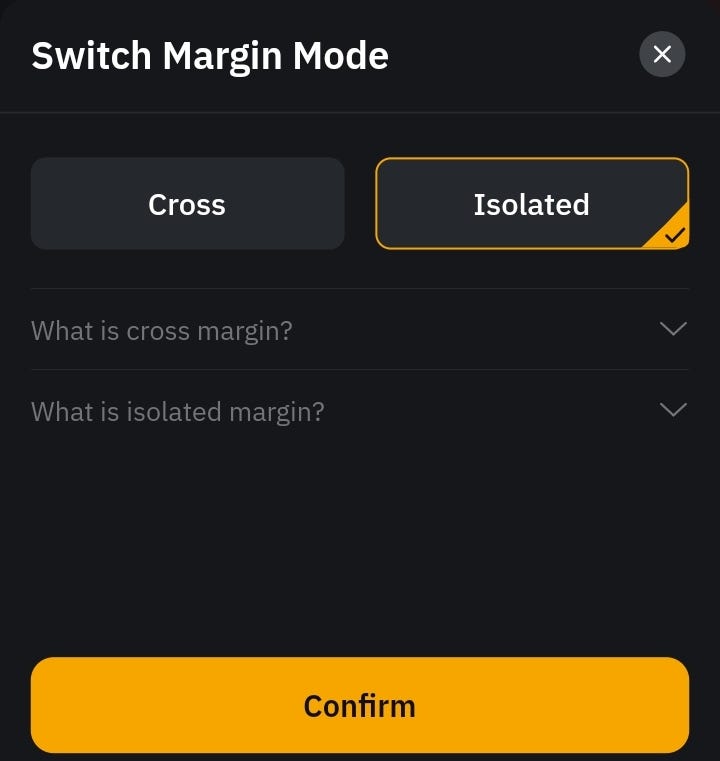

Differences Between Isolated and Cross Margin

When engaging in leveraged trading, your platform will prompt you to choose between isolated and cross-margin options.

Isolated margin lets you define the amount of assets you are willing to risk for each trade. In contrast, cross-margin indicates that you are prepared to risk your entire asset equity for the trade. Personally, I prefer using the “Isolated” margin when trading in the futures market, but feel free to experiment to determine what suits you best.

Section 1.1: Executing Trades

To execute a trade, you will need to select options such as “Limit”, “Order Price”, and “Quantity (Qty)”, followed by clicking “Open Long” to buy or “Open Short” to sell the asset. Additionally, you have the option to set your stop-loss and take-profit targets if you haven’t done so while initiating your position.

Section 1.2: Technical Analysis Essentials

Before entering a trading position, it’s imperative to conduct thorough technical analysis to predict the price movements of your selected trading pair. I generally focus on Bitcoin when trading futures as it largely influences the movement of other pairs and is less volatile compared to lower-cap altcoins.

For effective technical analysis, you’ll need to create an account with platforms like Tradingview.com or GoCharting.com. I lean towards GoCharting.com for its extensive tools available to free users.

Technical Analysis Tools

When analyzing the cryptocurrency market, utilizing effective tools and indicators is key. Fortunately, GoCharting.com provides access to high-quality tools and indicators for free. My personal favorites for chart analysis include EMAs, MACD, and RSI. For a deeper dive into free trading indicators, check out the article below.

Best 7 Free Trading Indicators for Every Cryptocurrency Trader

How to Leverage Crypto Trading

Having laid the groundwork, let’s discuss how to use leverage to enhance your position size. For example, if you are trading Bitcoin in the futures market and anticipate a price increase based on your analysis, you can open a Long (Buy) position. By applying 5%-10% leverage, you can enlarge your position size and potentially secure greater profits if the trade moves favorably. Conversely, if you foresee a price drop, you can opt for a Short (Sell) position. A solid grasp of technical analysis is essential to optimize your market engagement and increase your earnings.

Order form

Download Your Copy!

shorturl.at

Calculating Profits and Losses

When examining a trading pair like BTC-USD, it's critical to assess your risk-to-reward ratio prior to placing a trade. Here’s an example for clarity:

Example 1: Profit Scenario

Suppose you deposit $500 into your trading account and utilize 10x leverage. This allows you a position size of $5,000. If the market then shifts 10% in your favor, your profit could be $500. Closing the trade at this juncture means your total would rise to $1,000. Higher leverage can yield even greater returns, but it also escalates risk.

Example 2: Loss Scenario

On the other hand, if you commence trading with $500, using 10x leverage without a stop-loss, and the market moves against you by 10%, you could lose your entire trading capital. This highlights the necessity of setting both stop-loss and take-profit targets to shield your capital from liquidation.

Setting Risk-to-Reward Ratios

When trading Bitcoin, I generally adopt a risk-to-reward ratio of either 1:5 or 1:10 based on prevailing market conditions and volatility. This indicates a willingness to risk 1% of your capital to earn a return of 5%-10%. Consequently, even if you experience three losses and one win, you can still turn a profit with this approach. Thus, always establish stop-loss and take-profit targets for protection in the market.

Final Thoughts

Before diving into leveraged cryptocurrency trading, it’s vital to understand risk management, craft a trading strategy, and continuously educate yourself until you develop a reliable approach. Always remember to utilize stop-loss and take-profit targets to safeguard your investments.

I trust this information has been beneficial. If you found it useful, please give a clap and leave a comment below. Click Here to Subscribe and Follow Me.

Thanks for reading! You can Click Here to Join ByBit and Start Trading.

A Message from InsiderFinance

In this video titled "How To Make Money Trading CRYPTO FUTURES in 2023 As A Beginner (LIVE TRADE) (NO EXPERIENCE)", viewers will learn essential strategies for entering the crypto futures market. This guide is perfect for novices eager to start trading successfully.

The video "How to Make $300 a Day Trading Crypto In 2024 (BEGINNER GUIDE)" provides a comprehensive overview of techniques and tips to help beginners earn significant profits through crypto trading.