Understanding Jamie Dimon's Perspective on Bitcoin

Written on

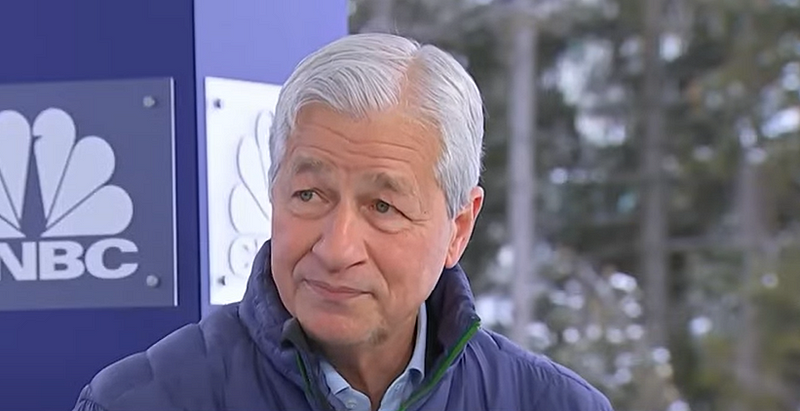

Chapter 1: Who is Jamie Dimon?

Jamie Dimon stands as a significant figure in the financial world, commanding attention as the CEO of JP Morgan Chase, one of the largest banking institutions globally. His reputation isn't solely tied to his role; it's also about his personal expertise in deal-making, profit generation, and navigating adversarial relationships.

Dimon’s extensive background includes a prestigious education, graduating with honors from Harvard Business School. Over the decades, he has climbed the corporate ladder, establishing himself as one of the most skilled leaders in finance. His ability to make strategic decisions promptly has enabled him to adeptly maneuver through the financial sector's complexities.

In a recent discussion, Dimon labeled Bitcoin as a “hyped-up fraud” and a “pet rock,” predicting its eventual decline in value. He stood firm in his assertion, dismissing the cryptocurrency's worth even when pressed during the conversation.

Chapter 2: Dimon’s Stance on Bitcoin

In a candid interview, Jamie Dimon expressed his skepticism regarding Bitcoin, emphasizing his belief that it lacks intrinsic value. He acknowledged the legitimacy of blockchain technology, which is foundational to Bitcoin, and noted that JP Morgan employs similar ledger systems.

During the interview, when asked about the growing interest from competitors like Blackrock in Bitcoin infrastructure, Dimon clarified his position:

“Bitcoin itself is a hyped-up fraud, the pet rock of the 21st century. It’s a waste of time, and I can’t fathom why you keep asking me about it. Investing in infrastructure is a different story. Blockchain is a legitimate ledger technology we use for various transactions.”

The first video titled "Everything You Need to Know About CRYPTO, & How to Gain WEALTH In the BITCOIN REVOLUTION | Raoul Pal" provides insights into the cryptocurrency landscape and investment strategies.

Despite Dimon's critical views on Bitcoin, JP Morgan has dipped its toes into the crypto waters. The bank allowed select private clients to invest in Bitcoin and other cryptocurrencies and even established a minor stake in Coinbase. However, as of mid-2022, the bank had divested its Coinbase shares but retained some bonds.

Chapter 3: Dimon’s Personal View

“I personally think Bitcoin is worthless,” Dimon stated. “I’m not here to promote Bitcoin; it doesn’t matter to me. Our clients are adults, and if they wish to engage with Bitcoin, we aim to provide them with the best access possible.”

Final Thoughts

It's often claimed that traditional finance figures harbor disdain for Bitcoin because it disrupts conventional economic paradigms. However, the reality may be more nuanced. The crypto sphere frequently seeks validation from established financial leaders.

Considering that Dimon is worth $1.6 billion and exhibits indifference towards Bitcoin, it raises questions about the desire for acceptance from traditional finance. Many Bitcoin investors might bristle at his categorization of the cryptocurrency as a “pet rock,” but his success lends weight to his criticism.

Dimon's remarks often stir controversy and debate, reflecting the broader struggle for cryptocurrency to gain legitimacy within mainstream finance.

For those invested in Bitcoin, the lack of endorsement from influential figures like Dimon can be disheartening. Ultimately, the digital asset market operates independently of traditional institutions, and its future remains uncertain.

The second video, "Everyone Is Wrong About Bitcoin: 'Have Fun Staying Poor!'" explores various misconceptions about Bitcoin and its place in the financial landscape.

Join my Substack today to receive daily insights from leading experts in Crypto, Business, Finance, and Technology, all for free.

Disclaimer: This article is intended for informational purposes only and should not be interpreted as financial, tax, or legal advice. Always consult with a qualified financial advisor before making significant financial decisions.