The Terra Luna Collapse: Analyzing Intent and Market Reactions

Written on

Chapter 1: The Speculation of Manipulation

The collapse of Terra Luna has sparked numerous theories regarding potential manipulation behind the scenes. Governments, including South Korea, have initiated investigations to examine these claims, aiming to determine if any wrongdoing occurred.

Three days prior to the collapse of Terra Luna, the Luna Foundation Guard executed a significant reserve purchase involving various cryptocurrencies:

- 80,394 $BTC

- 39,914 $BNB

- 26,281,671 $USDT

- 23,555,590 $USDC

- 1,073,554 $AVAX

- 697,344 $UST

- 1,691,261 $LUNA

While companies often seek to diversify their portfolios by acquiring new assets—especially in a declining market—the timing of this purchase, followed by the subsequent collapse of $LUNA, has led to speculation and concern among investors.

Section 1.1: Global Investor Sentiment

Many investors speculate whether there might have been a calculated plan to collapse the project, only to resurrect it later with a new initiative, potentially profiting from the aftermath. Given this uncertainty, many believe that now may not be the best time to invest in Terra Luna Classic, despite its recent advancements prior to listing on major exchanges.

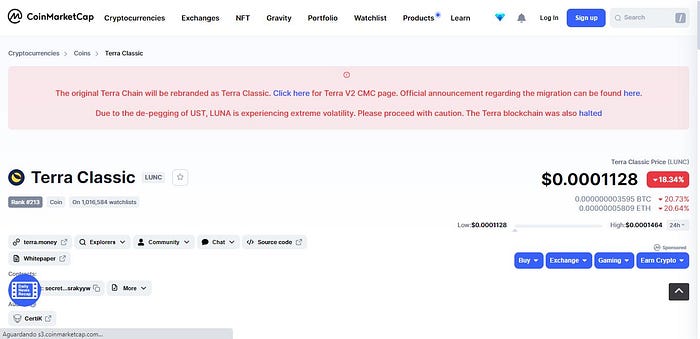

On May 31st, Binance announced via Twitter that it would list LUNAC, which could potentially lead to a surge of interest from its vast user base of over 90 million. However, the question remains: how safe is this investment?

Subsection 1.1.1: Investor Caution and Market Trust

The crux of the issue for investors lies in the fear that another disaster may be on the horizon. Following the catastrophic collapse that impacted significant economies, confidence has waned, prompting a cautious approach to investing in the new iteration of Terra Luna.

Though I personally don't believe there was any malicious intent, we cannot discount any possibilities. The fallout was monumental, with millions of dollars lost in mere hours, leaving investors scrambling with little time to react. Given the rapidity of the collapse, it seems implausible that any deliberate sabotage aimed to dismantle the project was at play.

However, it remains crucial for investors to exercise vigilance. Projects can falter unexpectedly, and while those who invested in Terra Luna may not have erred in their judgment, their experience serves as a reminder of the inherent risks in cryptocurrency investments.

Chapter 2: Understanding the Aftermath

The first video titled "Terra, LUNA & UST Collapse: What Happened? Inside Story!!" delves into the events surrounding the Terra Luna collapse, exploring the circumstances and reactions from the community.

The second video, "UST Luna - The Biggest COLLAPSE in Crypto History," provides a comprehensive overview of the implications of the collapse and its significance in the broader context of cryptocurrency history.

Be sure to explore additional insights in the stories linked below.